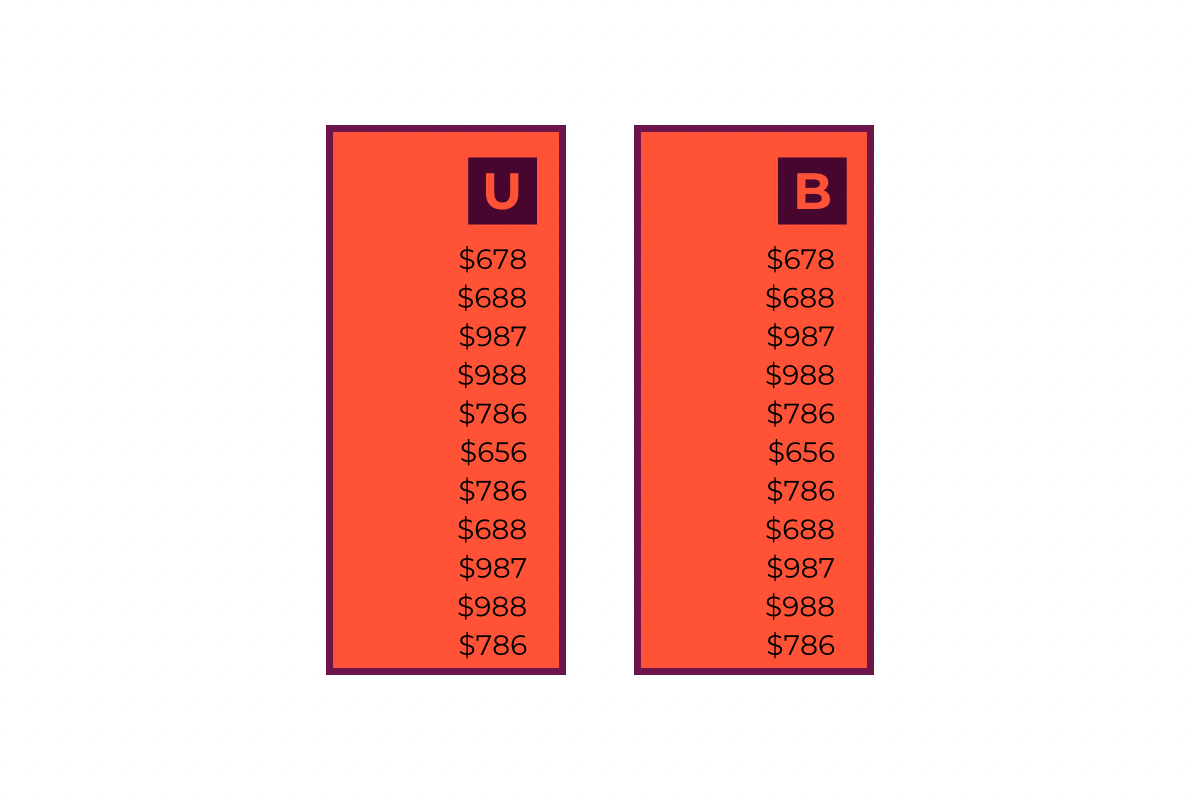

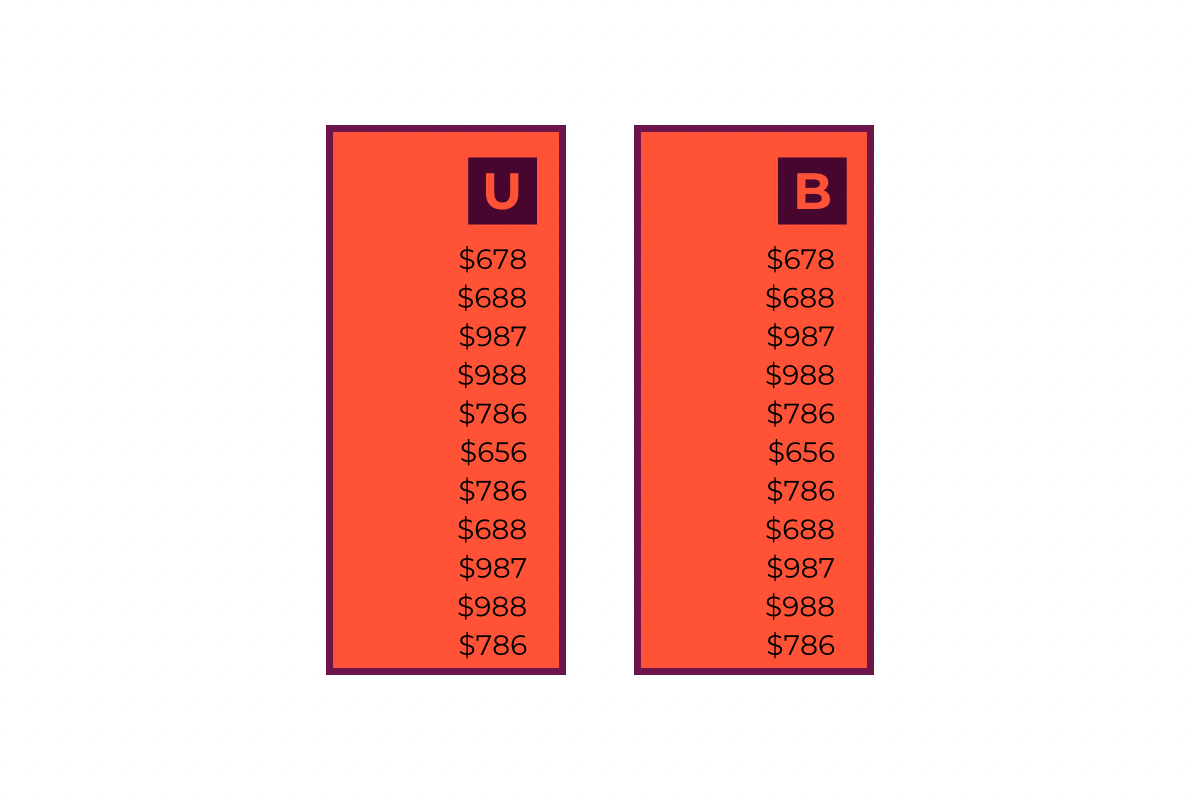

Variance in accounting is the difference between an expected and an actual result, pivotal for assessing project performance and budget adherence.

Definition, Formula, and Analysis of Variance in Accounting

Variance in accounting is the difference between an expected and an actual result, pivotal for assessing project performance and budget adherence.

Get a basic understanding of double-entry bookkeeping, its importance for small businesses and its role in accurate financial records.

Learn the purpose of Chart of Accounts (COA) numbering and its role in organizing financial information efficiently.

FCFF indicates cash availability after operating expenses and capital investments, reflecting a company’s true cash flow capability.

The 5-step revenue recognition process includes identifying contract, performance obligations, transaction price, and recognizing revenue upon fulfilling obligations.

A chart of accounts functions as a vital financial roadmap for small business, crucial for overview, compliance, and decision making.

Learn the purpose of Chart of Accounts (COA) numbering and its role in organizing financial information efficiently.

Opex represents the ongoing costs for running a business, directly influencing operational efficiency and overall financial performance.

Explore the top bookkeeping software for small businesses in 2024, with customizable features and user-friendly interfaces for seamless financial management.

Learn how financial statement analysis enables comprehension of a company’s operational efficiency and potential growth.