Learn how to manage and reduce G&A expenses with effective strategies, including cost-reduction opportunities and tracking for better financial efficiency.

General and Administrative Expenses: A Basic Guide

Learn how to manage and reduce G&A expenses with effective strategies, including cost-reduction opportunities and tracking for better financial efficiency.

Master the operating income formula and learn how to calculate it for accurate financial analysis and improved business profitability.

AR Turnover Ratio measures how well a company collects revenue and uses its assets. Learn how to calculate with examples, interpret and improve AR Turnover.

Learn how to calculate and manage burn rate in business with actionable strategies, understand its impact on cash flow, and optimize financial performance.

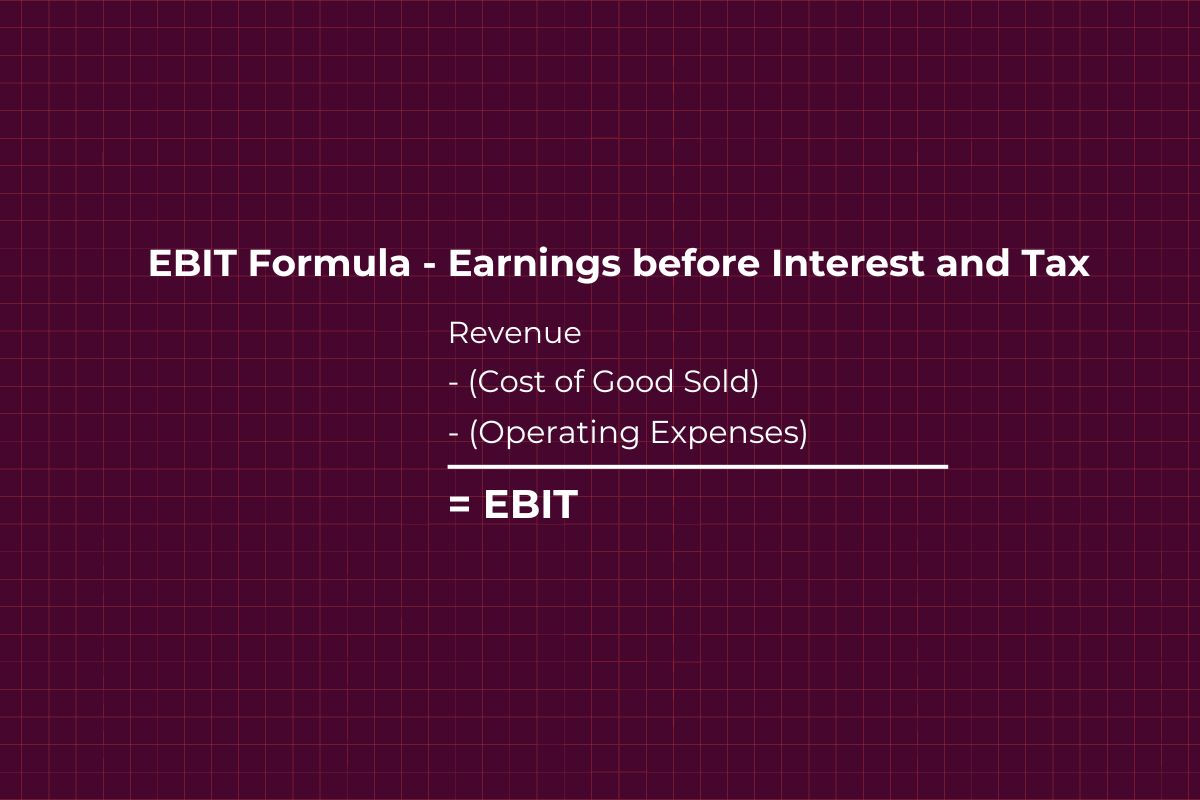

You might know EBIT as the financial metric to measure a company’s operational profitability. But do you know its practical uses or limitations? No? Don’t worry; this article will clear all your doubts about EBIT, including practical calculations, variations, and comparisons with other metrics. What is EBIT? EBIT, or Earnings Before Interest and Taxes, is… Continue reading Understanding EBIT: Earnings Before Interest & Taxes Calculation

Explore a detailed example of cash flow statement, revealing net cash flow and ending balance calculations.

Understanding financial analysis of a company aids informed decision-making by analyzing company’s efficiency, profitability and operational metrics.

Our blog provides actual balance sheet examples and summarizes key figures tied to the assets, liabilities, and equity equation.

Master investor relations with transaction level visibility and financial reports. Elevate your strategy with Bunker’s data-driven solutions. Learn more!

Annual Recurring Revenue, vital for subscription-based businesses, incorporates revenue from new and existing subscriptions, upgrades, and lost revenue.