Expense is defined as costs incurred to earn revenue. It’s crucial to manage and categorize them effectively for financial success.

Comprehensive Guide on Understanding Expense

Expense is defined as costs incurred to earn revenue. It’s crucial to manage and categorize them effectively for financial success.

A cash flow statement reports cash generated and spent during a specific period. Understand how to prepare a cash flow statement with this guide.

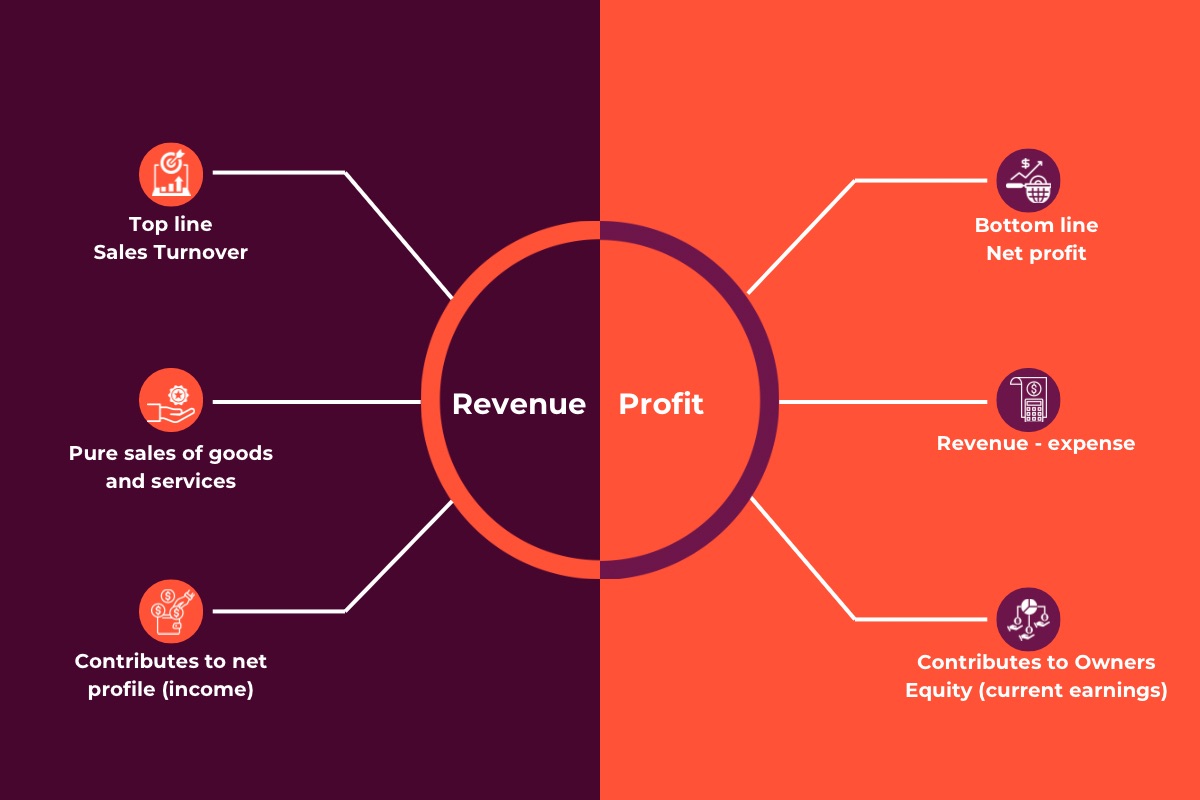

Discover what revenue and profit are and why understanding their differences is crucial for business success. Learn actionable strategies to optimize both.

Confused about accounts Payable vs receivable? This handbook will help you understand the differences and similarities to make error-free, informed decisions.

Learn how to read and analyze financial statements and create a financial summary for effective business decision-making.

The Advanced FP&A Guide provides finance professionals with actionable insights to improve financial planning and decision-making and boost business success.

Knowing the Income Statement format is vital for CFOs/Financial Controllers. Master Preparing and Analyzing Income Statements with their Components and Examples.

Gross profit, referred to as gross income or sales profit, is the revenue after deducting the cost of goods sold (COGS).

Accounts receivable, is the money owed to a company by customers for past purchases, playing a critical role in its financial health.

Master the calculation of net operating cash flow and learn how to interpret it. Unlock insights into your business’s financial health today!