As a CFO, managing a company’s financial runway can feel like walking a tightrope. The constant pressure of ensuring the business doesn’t run out of money while juggling operational expenses, taxes, and investor expectations can be overwhelming. Poor financial reporting can only add to your stress, making it difficult to understand the company’s financial health, forecast cash flow, or make informed strategic decisions.

Accurate, timely, and comprehensive financial reporting in accounting is essential for managing cash flow, ensuring compliance, and maintaining stakeholder transparency. Without it, you risk not only falling behind financially but also losing investor trust and facing compliance penalties.

Whether you’re running a startup or managing a large enterprise, financial reporting is key in supporting strategic decision-making, investment opportunities, and long-term growth.

In this guide, we’ll explore the importance of financial reporting and the types of reports every CFO should have at their fingertips.

Significance of Financial Reporting in the Business Landscape

Nowadays, financial reporting plays a critical role in providing transparency, accountability, and strategic insight. It ensures compliance with regulatory standards, builds trust with investors, and supports informed decision-making. Accurate financial reports will allow you to evaluate performance, manage cash flow, and identify growth opportunities.

Financial reporting also strengthens our corporate governance by keeping things transparent and holding us accountable. When you have detailed financial statements, everyone can see how you manage your resources and if you’re meeting your goals. This will help you stick to ethical practices and make sure your management is looking out for the best interests of your shareholders and stakeholders, which builds trust for the long term.

And you know what? Reliable financial data is key for attracting investors and getting financing. It shows that we’re stable and have potential. Reporting helps you see your profitability and financial health, which helps you keep growing and stay ahead in the market.

Consequences of Inadequate Financial Reporting

Inadequate financial reporting can lead to severe consequences, from poor decision-making to increased fraud risks. Investors and stakeholders demand transparency, and when financial data is inconsistent or incomplete, it can damage your reputation and hinder your ability to attract capital. Moreover, regulatory non-compliance can result in significant fines and legal challenges, putting your business at risk of financial instability.

To avoid these pitfalls, you need to prioritize robust financial reporting strategies. By investing in accurate, detailed financial data, companies safeguard themselves from regulatory issues and empower themselves to drive strategic growth.

Importance of Financial Reporting

Financial reporting is an essential component of effective business management. It will provide you with a clear and accurate view of your organization’s financial performance and position.

1. Ensuring Tax Compliance

Financial reporting ensures businesses comply with local, state, and federal tax regulations. Properly documented financial statements help companies accurately calculate their taxable income, reducing the likelihood of audits or penalties. By following standard accounting practices, businesses can stay within the boundaries of the law and maintain a transparent relationship with tax authorities.

2. Showing Financial Condition to Potential Investors

Understanding a company’s financial health is essential for you before making an investment decision. Financial reports such as balance sheets, income statements, and cash flow statements give potential investors a clear picture of a company’s profitability, liquidity, and overall financial stability. These reports help them assess risks and forecast future performance, enabling more informed investment choices.

3. Evaluating Operations at Scale

Detailed financial reporting allows businesses to evaluate the efficiency of their operations. By analyzing key financial metrics, managers can identify areas that need improvement, such as cost control, revenue generation, and resource allocation. Consistent reporting at scale helps organizations adjust their strategies to optimize performance.

4. Examining and Analyzing Cash Flow

One of the core components of financial reporting is the cash flow statement, which highlights how much cash a company is generating and spending over a given period. Proper cash flow analysis enables businesses to monitor liquidity, ensuring that they have enough funds to meet short-term obligations. This is crucial for maintaining financial stability, especially during periods of growth or market fluctuations.

5. Examining and Distributing Information on Shareholder Equity

The statement of changes in equity outlines how equity has evolved over time. It tracks retained earnings, shareholder dividends, and other transactions not reflected on the income statement or balance sheet. Financial reporting provides a detailed view of how shareholder equity is distributed, which is critical for company owners and investors.

Ultimately, effective financial reporting enhances transparency and accountability and serves as a foundation for strategic decision-making and long-term success.

Types of Financial Reports

When it comes to financial management, understanding the different types of financial reports is essential for making informed decisions and ensuring the health of your business.

1. Balance Sheet

The balance sheet provides a snapshot of a company’s financial health at a specific point in time. It outlines assets, liabilities, and equity, offering a comprehensive view of what a company owns and owes. Investors and stakeholders rely on the balance sheet to assess the company’s financial stability and its ability to meet long-term obligations.

2. Income Statement

An income statement, also known as a profit and loss (P&L) statement, provides an overview of a company’s revenues, expenses, and profits or losses over a period of time. This report offers insight into the company’s profitability, helping decision-makers understand where money is being earned and spent.

3. Cash Flow Statement

A cash flow statement tracks the inflows and outflows of cash within a company. By providing insights into liquidity and solvency, it helps stakeholders understand how well a company manages its cash, particularly in operations, investing, and financing activities.

4. Statement of Changes in Equity

This report outlines the changes in shareholder equity over a specific period. It tracks retained earnings, dividends, and other adjustments that impact a company’s equity. This document is essential for investors seeking to understand the company’s dividend policies and overall equity structure.

5. Notes to Financial Statements

The notes accompanying financial statements provide additional context and details that enhance the reliability and accountability of the reports. These notes help explain how certain figures were calculated, outline accounting policies, and provide additional information that may not be reflected directly in the financial statements.

Knowing the various types of financial reports and their unique purposes will enable you to analyze your organization’s financial health effectively and make strategic decisions that drive growth.

Benefits of Financial Reporting

Financial reporting plays a crucial role in the success of any organization, providing transparency and insights that drive informed decision-making. Let’s check out the benefits of financial reporting.

1. Optimized Debt Management

Financial reports provide an accurate picture of a company’s debt obligations. With this information, businesses can manage debt more effectively, ensuring that they can meet interest payments and repay loans on time.

2. Real-time Insights for Informed Decisions

Real-time financial reporting gives business leaders up-to-date insights into their company’s financial performance. With this data, decision-makers can respond quickly to emerging trends, making proactive adjustments to business strategies.

3. Forecasting and Identifying Business Trends

Consistent financial reporting helps companies identify patterns and trends in their financial data, allowing them to forecast future performance more accurately. This enables businesses to anticipate challenges, allocate resources effectively, and stay competitive in a rapidly changing market.

4. Asset and Liability Management

Effective financial reporting helps businesses track their assets and liabilities. By monitoring these key areas, companies can ensure they maximize asset performance while minimizing liabilities, leading to stronger financial health.

5. Ease of Access to Comprehensive Financial Records

Well-maintained financial reports offer easy access to comprehensive records, making it simpler for businesses to track financial performance over time. This accessibility supports more efficient auditing, financial planning, and compliance with regulatory requirements.

In the end, financial reporting’s benefits extend beyond compliance, enabling businesses to optimize performance, foster accountability, and build trust with stakeholders.

Strengthen Your Financial Reporting Strategy

A solid financial reporting strategy is more than just a compliance exercise—it’s the foundation for sustained growth and strategic decision-making. Accurate, timely, and detailed financial reports are crucial to maintaining transparency, meeting regulatory obligations, and building long-term trust with investors, regulators, and stakeholders.

These reports offer a clear snapshot of your company’s financial health, empowering you to make data-driven decisions that enhance operational efficiency and fuel future growth.

Ensure Compliance and Transparency:

In today’s complex regulatory landscape, compliance is a must, not an option. Robust financial reporting ensures that your business adheres to both local and international accounting standards, avoiding costly penalties and legal issues. Meeting tax obligations is just one part of the equation—clear, transparent reporting also fosters trust with shareholders, regulatory bodies, and potential investors.

By demonstrating accountability and precision in your financial disclosures, you show that your business is well-managed and operates with integrity.

Enhance Strategic Decision-Making:

Financial reports are not just static documents—they’re dynamic tools that unlock valuable insights into your company’s operations and performance. By maintaining comprehensive and precise reports, you better understand critical financial metrics such as profitability, cash flow, and asset management.

With this data at your fingertips, you can make smarter decisions about where to allocate resources, which areas of the business require attention, and how to capitalize on new opportunities. Whether it’s scaling operations, cutting unnecessary costs, or planning future investments, accurate financial reporting is your roadmap to success.

In short, an optimized financial reporting strategy is more than compliance—it’s about unlocking your business’s full potential through informed, proactive decision-making.

Simplify Reporting with Bunker

Bunker offers advanced tools to streamline financial reporting, ensuring accurate, real-time data that supports your accounting needs and business growth.

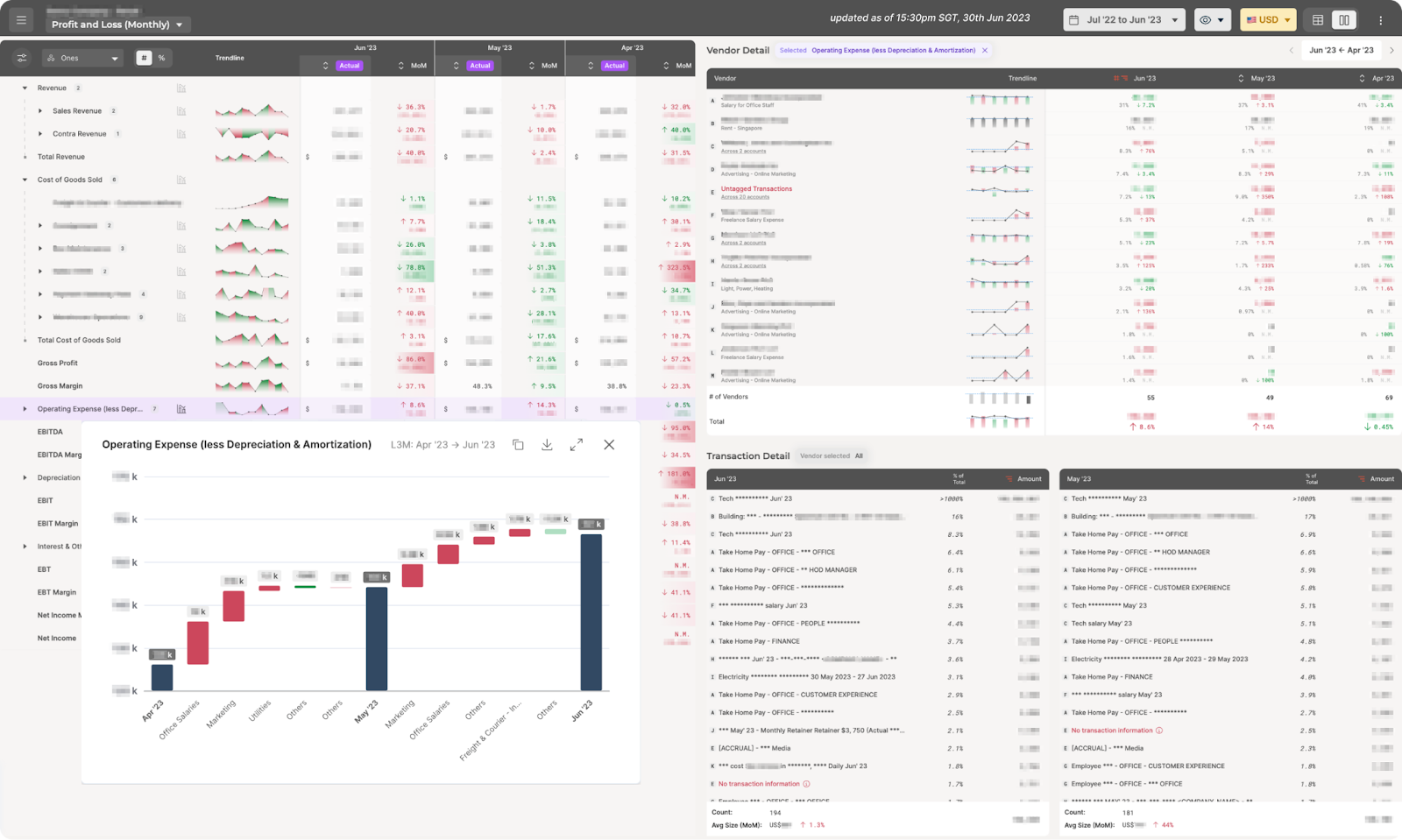

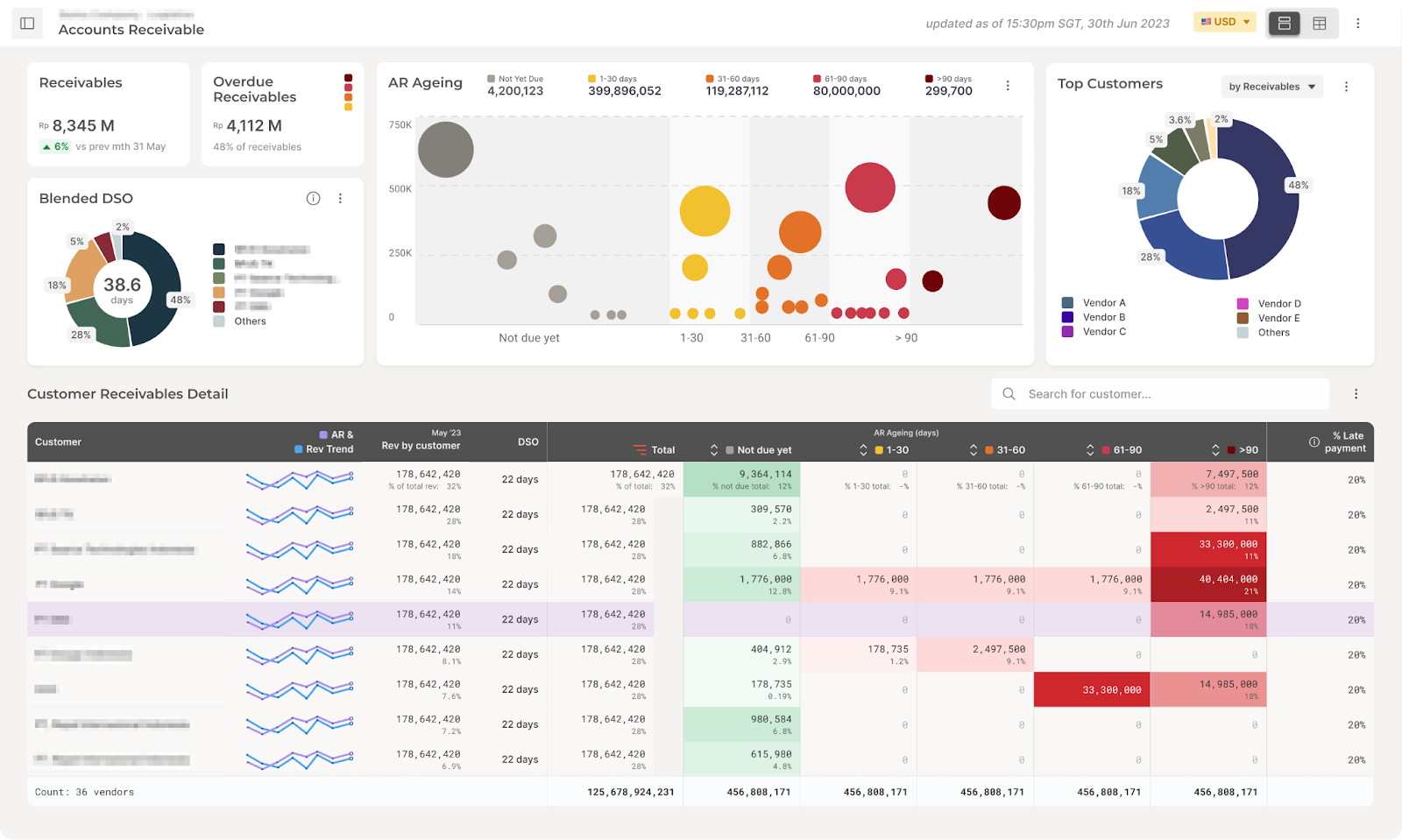

Real-time Data: Bunker’s dashboards allow you to quickly assess P&L performance against prior periods. This feature enables you to identify trendline movements at a glance, generate insightful commentary to explain the variance, and spot potential areas of concern or improvement without endlessly digging into spreadsheets.

Eliminate Manual Reporting: Our intelligent solution processes rows of data and gives you answers without painful and time-consuming manual processes.

Spot Accounting Errors: Bunker’s dashboard highlights significant anomalies like missing entries or odd attributions. It serves as an effective tool for a sanitized check of your books after pre-close. It provides vendor and transaction-level drill-downs without the need for time-consuming data extractions from accounting software.

Additionally, Bunker’s monthly report summarizes key data from the General Ledger, offering actionable insights just days after your close.

By leveraging robust financial reporting practices, you can ensure compliance, support strategic decision-making, and foster long-term success. With tools like Bunker, you can simplify and optimize your financial reporting, ensuring accuracy and real-time insights that drive growth.

Effective financial reporting is the backbone of any successful business. It ensures compliance with regulatory standards and provides valuable insights into a company’s financial health, helping decision-makers chart a path for growth and long-term stability.

However, managing financial reports can be time-consuming and prone to errors, especially if done manually. That’s where Bunker comes in. With Bunker’s advanced financial reporting tools, you can simplify the process, access real-time insights, and eliminate manual reporting errors while ensuring your business remains compliant and transparent.

Say goodbye to manual reporting headaches and hello to streamlined, real-time financial insights.

Try Bunker today to transform your financial reporting and drive business growth!