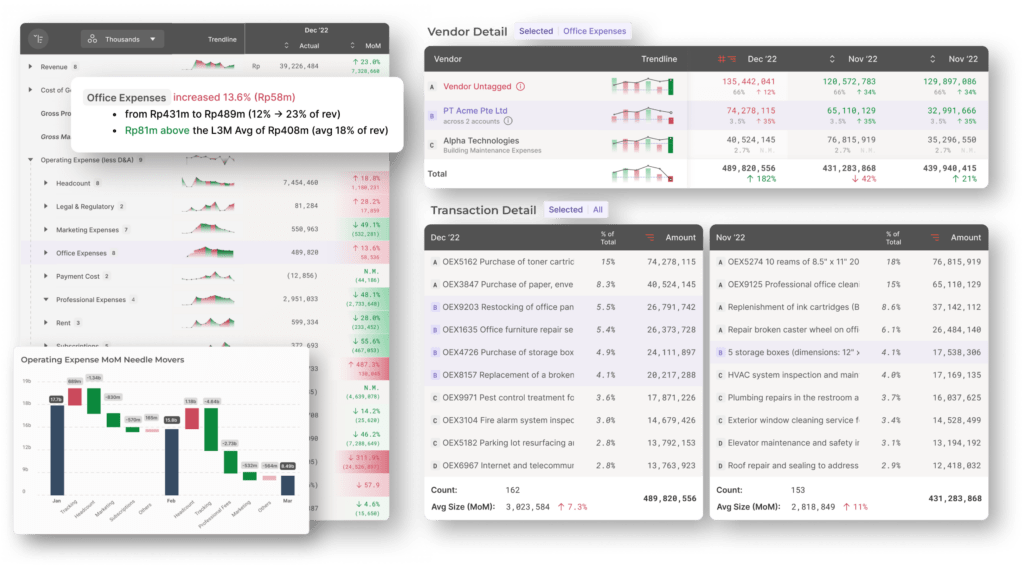

Bunker is a modern financial analytics platform that propels executives into a new era of financial visibility, by turning the thousands of overlooked rows in the general ledger into actionable insights.

Much like a military bunker, the platform is a safe and secure stronghold where leaders are away from the noise, and able to leverage precise insights to focus on strategy and tactics.

What it is:

The platform features two means of providing C-suites financial visibility at speed:

How Bunker’s technology works:

Bunker’s software connects with its clients’ accounting or ERP software to pull the thousands of rows of most granular data such as the general ledger and accounts receivable ageing data directly into its backend, implementation is then entirely managed by Bunker and takes days, not weeks. No complex training is required.

Bunker has raised over US$5M with the backing of institutional investors including January Capital, Alpha JWC, Global Founders Capital, Northstar Group, Money Forward, Alpine Ventures, and Patamar Capital all while in stealth.

The company’s solution was conceived after an early acquisition of bookkeeping and tax services consultancy, Proyek Beta, now a subsidiary called Bunker Books.

Bunker has processed over 2M rows of general ledger data across 3.5k accounts for its clients, providing insights for the 20k vendors and 10k customers

Financial governance issues on the rise

Too much data, too few people

Too much data, too little time

The nascency of software in APAC